Submitted by ikara on March 25, 2018

In 2015, the Financial Stability Board (FSB), chaired by Mark Carney —at the request of G20 leaders— launched its Task Force on Climate-Related Financial Disclosures (TCFD or Task Force). The Task Force, which is chaired by Michael Bloomberg, published their final recommendations for effective disclosure of climate related financial risks in June 2017. This joint CDSB and CDP research assesses the level of preparedness of companies to disclose material climate-related information according to the TCFD recommendations. It focuses on the companies’ reporting practices and management processes for climate-related matters, and whether there are any significant geographical or sectorial variations.

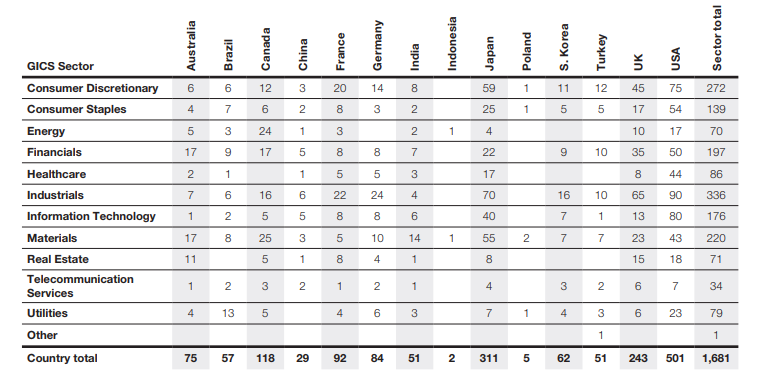

CDP in collaboration with Climate Disclosure Standards Board (CDSB) published “Ready or not: Are companies prepared for the TCFD recommendations?” report looks at the disclosures from 1,681 companies across 14 countries and 11 sectors to the CDP Questionnaire in 2017, which were made around the time of the launch of the final TCFD.

In this report, 51 countries from Turkey are examined.

The TCFD identified four core elements of climaterelated financial disclosures, related to the following thematic areas: 1. Governance: The organization’s governance around climate-related risks and opportunities. 2. Strategy: The actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning. 3. Risk Management: The processes used by the organization to identify, assess, and manage climate-related risks. 4. Metrics & Targets: The metrics and targets used to assess and manage relevant climaterelated risks and opportunities. These four core areas are supported by recommended disclosures (including scenario analysis) and guidance (both general and sectorspecific). The recommendations, disclosures, and guidance all rest on a set of underlying principles intended to facilitate high-quality, decision-useful disclosures even as the market’s understanding of, and approach to, climate-related impacts evolves over time.

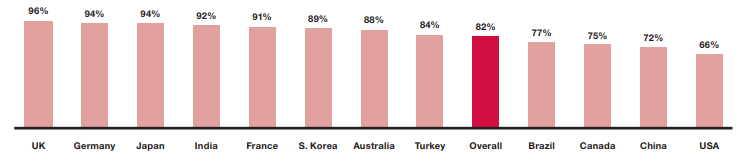

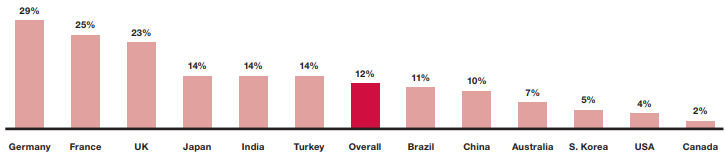

Our analysis shows that there is a disconnect between where the responsibility sits for overseeing climate-related risks and opportunities and the responsibility for managing them. There remains a significant gap between oversight and consequences. Indeed, while 82% of companies have board-level oversight of climate-related risks and opportunities, only 12% provide monetary and non-monetary incentives to board members for the management of climate change issues within the organization. 84% of 2017 CDP responder companies from Turkey has board-level oversight of climate change issues while 82% of overall companies have board-level oversight of climate change issues.

14% of 2017 CDP responder companies from Turkey are providing incentives to the board for the management of climate change issues while 12% overall companies providing incentives to the board for the management of climate change issues.

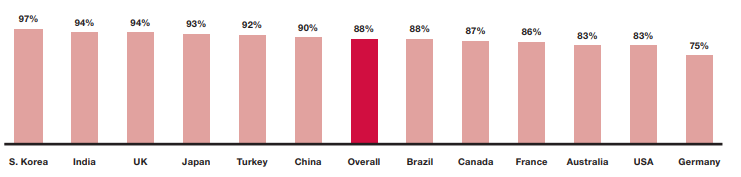

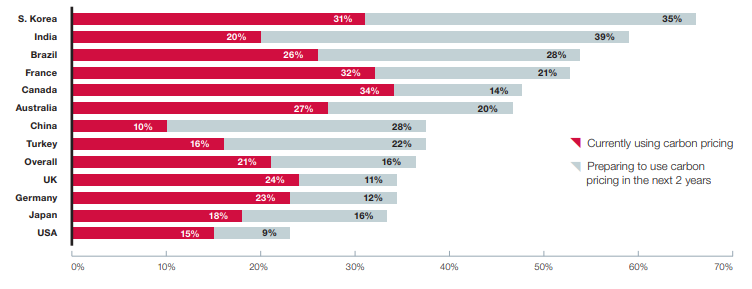

In the future, carbon taxes or similar schemes are likely to be used as a mechanism to regulate global emissions. In order to help understand and quantify potential climate risk impacts, the TCFD recommends, where relevant, disclosing internal carbon prices. Globally, 21% of companies currently report using an internal carbon price. Companies in Canada (34%) and France (32%) currently use carbon pricing the most while companies in Turkey carbon pricing used by %16 of responder companies while China (10%) and the US (15%) use it the least.

Read full version of “Ready or not: Are companies prepared for the TCFD recommendations?” Report from here.