Submitted by ikara on April 26, 2018

In 2017, CDP and the We Mean Business Coalition launched the Carbon Pricing Corridors initiative with the aim of enabling large market players to define the carbon prices needed for industry to meet the goals of the Paris Agreement. The inaugural report was published in May 2017 with a focus on the power sector, considered by some as the foundation of the low-carbon transition. This new report features an update on the power sector a year following the initial inquiry process and a new Corridor for the chemical sector.

This report includes;

1. Companies and investors must anticipate and mitigate the financial risks driven by climate change.

This requires adapting to significant physical environmental changes and wide-ranging, unpredictable shifts in market conditions as we transition to a low-carbon economy. Market actors need to prepare for a range of potential scenarios.

2. The Task Force on Climate-related Financial Disclosures (TCFD) outlines a framework of recommendations to manage climate-related risks and opportunities, including the application of internal carbon pricing in scenario analysis.

The TCFD recommends that organizations use scenario analysis to test their business models and investments against a range of forward-looking scenarios – including a 2°C scenario (assuming a framework in line with the ambitions of the Paris Agreement).

3. Internal carbon pricing has emerged as a forward-looking metric that can help organizations manage climate-related transition risks and opportunities.

In 2017, over 1,400 companies disclosed using or planning to use an internal carbon price. Companies can use an internal carbon price as a risk and opportunity proxy for (1) government policies that put an explicit price on carbon, via emissions trading systems and taxes, and additionally, (2) implicit carbon pricing signals in the economy that may arise from shifting technological, regulatory and market dynamics. The combination of these factors and explicit carbon pricing policies creates a signal indicating the present and future costs of carbon.

4. The Corridors Panel is composed of 29 senior business leaders and experts exploring how investors and companies can use a range of carbon prices, over different time horizons (the Carbon Price Corridor), as a metric to price transition risk into operational and investment decisions. They have provided insider views into how carbon-related price signals will and need to develop if we are to achieve the transformational emissions reduction goals that governments and private sector actors have set themselves, as defined by the Paris Agreement on climate change.

5. This report includes a new Corridor for the chemical sector and an updated Corridor for the power sector. These can be used by a wide range of actors with an interest in the changes taking place in these markets – including business and financial actors seeking to align their business and investment strategies with the Paris Agreement, and policymakers, as they seek to align policy frameworks to achieve their climate goals. For further reference, the initiative developed a ‘user matrix’ detailing how different sectors could use the Corridors, over various time periods, to benchmark their business decisions against carbon-related price signals.

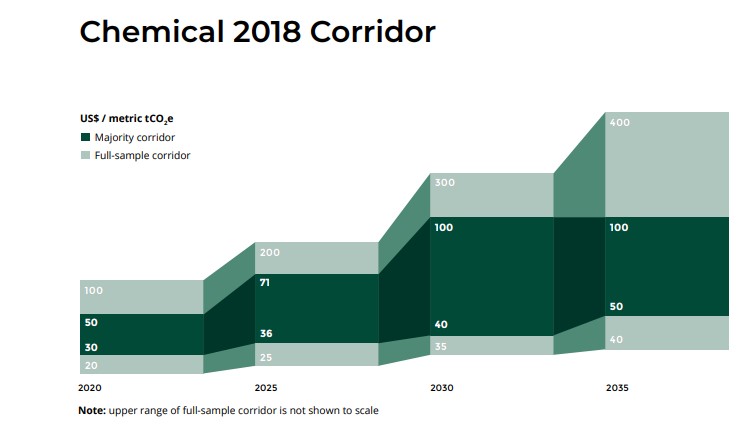

6. In the short-term (2020), 50% of panelists from the chemical sector needed USD 30-50/tonne as the carbon price corridor needed to strategic planning and investment decision-making and catalyze emissions reductions. These price signals will need to steadily increase over time, reaching USD 50-100/tonne for 2035, to drive the innovation and investment needed to decarbonize in line with the Paris Agreement. Panel members noted that the diverse and complex nature of the chemical industry makes it challenging to define a common decarbonization pathway for widespread reference.

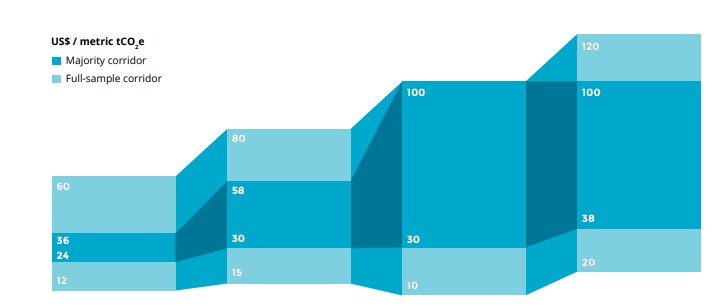

7. Power sector respondents strongly considered market and economic factors in determining the price level needed to drive change (e.g. developments in underlying economic factors such as power and commodity prices and the levelized cost of renewables). 50% of the power sector panel identified USD 24-35/tonnes as the needed range of carbon price signals in the short-term (2020) to drive fuel switching and renewables deployment, rising to USD 38-100/tonne by 2035 reflecting the case for other technologies such as battery storage or CCS.

8. In both sectors there is uniform recognition of the need for increasing carbon pricing signals, but there is a lack of confidence that this is likely to be achieved via explicit carbon pricing policies in the short-term. While there is more optimism for the medium- to longterm, there is widespread agreement that additional policy mechanisms will be needed to drive investment decisions and the decarbonization of both the power and chemical sectors. This has implications for long-term capital investments being made today.

9. Ensuring that investments are robust in the face of these price ranges will be important to support the financial performance of companies and portfolios in the medium- to long-term. This in turn will help enable the transformation of the economy, improve the ability to identify low-carbon innovation opportunities, and decrease systemic climate risk.

Please click here to find the report.